How Much Is Property Tax In Frisco Tx . this notice concerns the 2022 property tax rates for city of frisco. local property taxes are based on the value of taxable property called ad valorem, which means according to value in latin. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the texas and u.s. This notice provides information about two tax rates used in. to calculate your property taxes in frisco, multiply the total tax rate by each $100 of your property's assessed. look at tax rates for collin county and denton county. Property tax rates vary depending on the county and the school district where your home is located. the city has one of the lowest property tax rates in texas among towns with a population of 50,000 or more, at $0.4466 per year.

from everytexan.org

the city has one of the lowest property tax rates in texas among towns with a population of 50,000 or more, at $0.4466 per year. to calculate your property taxes in frisco, multiply the total tax rate by each $100 of your property's assessed. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. This notice provides information about two tax rates used in. Property tax rates vary depending on the county and the school district where your home is located. this notice concerns the 2022 property tax rates for city of frisco. look at tax rates for collin county and denton county. local property taxes are based on the value of taxable property called ad valorem, which means according to value in latin. Compare your rate to the texas and u.s.

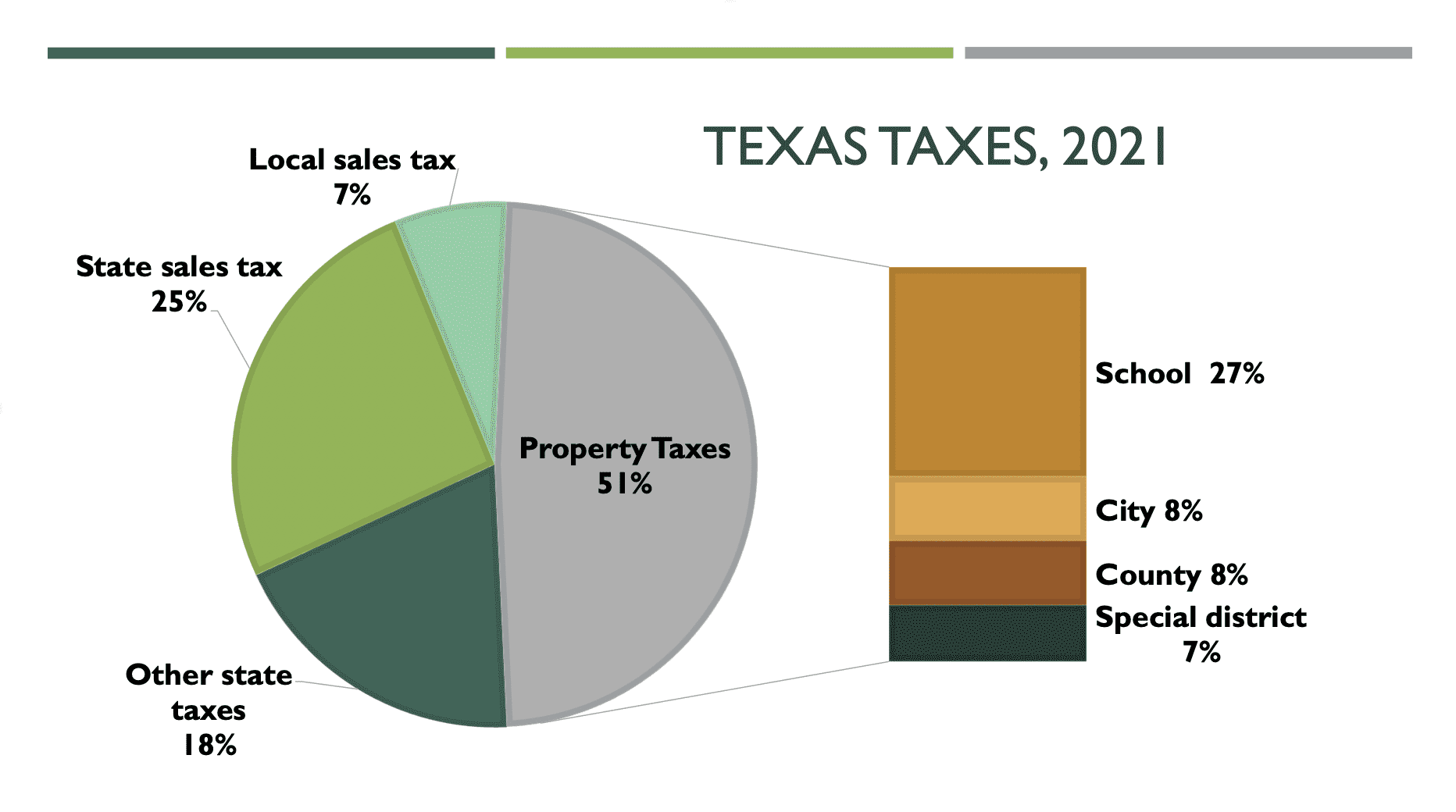

Who Pays Texas Taxes? (2023) Every Texan

How Much Is Property Tax In Frisco Tx This notice provides information about two tax rates used in. local property taxes are based on the value of taxable property called ad valorem, which means according to value in latin. this notice concerns the 2022 property tax rates for city of frisco. Compare your rate to the texas and u.s. look at tax rates for collin county and denton county. Property tax rates vary depending on the county and the school district where your home is located. the city has one of the lowest property tax rates in texas among towns with a population of 50,000 or more, at $0.4466 per year. to calculate your property taxes in frisco, multiply the total tax rate by each $100 of your property's assessed. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. This notice provides information about two tax rates used in.

From texasscorecard.com

Frisco Raising Property Taxes Texas Scorecard How Much Is Property Tax In Frisco Tx calculate how much you'll pay in property taxes on your home, given your location and assessed home value. look at tax rates for collin county and denton county. to calculate your property taxes in frisco, multiply the total tax rate by each $100 of your property's assessed. Compare your rate to the texas and u.s. local. How Much Is Property Tax In Frisco Tx.

From vanesahoskins.blogspot.com

total property tax in frisco tx Vanesa Hoskins How Much Is Property Tax In Frisco Tx calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the city has one of the lowest property tax rates in texas among towns with a population of 50,000 or more, at $0.4466 per year. Compare your rate to the texas and u.s. local property taxes are based on. How Much Is Property Tax In Frisco Tx.

From everytexan.org

Who Pays Texas Taxes? (2023) Every Texan How Much Is Property Tax In Frisco Tx Compare your rate to the texas and u.s. local property taxes are based on the value of taxable property called ad valorem, which means according to value in latin. this notice concerns the 2022 property tax rates for city of frisco. the city has one of the lowest property tax rates in texas among towns with a. How Much Is Property Tax In Frisco Tx.

From www.hiestates.com

Understanding Property Tax in Oahu for 20242025 How Much Is Property Tax In Frisco Tx to calculate your property taxes in frisco, multiply the total tax rate by each $100 of your property's assessed. this notice concerns the 2022 property tax rates for city of frisco. Compare your rate to the texas and u.s. local property taxes are based on the value of taxable property called ad valorem, which means according to. How Much Is Property Tax In Frisco Tx.

From www.yoursurvivalguy.com

The Highest Property Taxes in America Your Survival Guy How Much Is Property Tax In Frisco Tx local property taxes are based on the value of taxable property called ad valorem, which means according to value in latin. This notice provides information about two tax rates used in. to calculate your property taxes in frisco, multiply the total tax rate by each $100 of your property's assessed. look at tax rates for collin county. How Much Is Property Tax In Frisco Tx.

From texasscorecard.com

Commentary How Property Taxes Work Texas Scorecard How Much Is Property Tax In Frisco Tx look at tax rates for collin county and denton county. Property tax rates vary depending on the county and the school district where your home is located. this notice concerns the 2022 property tax rates for city of frisco. This notice provides information about two tax rates used in. Compare your rate to the texas and u.s. . How Much Is Property Tax In Frisco Tx.

From vanesahoskins.blogspot.com

total property tax in frisco tx Vanesa Hoskins How Much Is Property Tax In Frisco Tx Property tax rates vary depending on the county and the school district where your home is located. this notice concerns the 2022 property tax rates for city of frisco. This notice provides information about two tax rates used in. Compare your rate to the texas and u.s. the city has one of the lowest property tax rates in. How Much Is Property Tax In Frisco Tx.

From www.expressnews.com

Bexar property bills are complicated. Here’s what you need to know. How Much Is Property Tax In Frisco Tx This notice provides information about two tax rates used in. look at tax rates for collin county and denton county. Property tax rates vary depending on the county and the school district where your home is located. this notice concerns the 2022 property tax rates for city of frisco. local property taxes are based on the value. How Much Is Property Tax In Frisco Tx.

From printablemapjadi.com

How High Are Spirits Taxes In Your State? Tax Foundation Texas How Much Is Property Tax In Frisco Tx Compare your rate to the texas and u.s. Property tax rates vary depending on the county and the school district where your home is located. local property taxes are based on the value of taxable property called ad valorem, which means according to value in latin. to calculate your property taxes in frisco, multiply the total tax rate. How Much Is Property Tax In Frisco Tx.

From www.zillow.com

The Highest and Lowest Property Taxes in Texas Zillow Porchlight How Much Is Property Tax In Frisco Tx this notice concerns the 2022 property tax rates for city of frisco. the city has one of the lowest property tax rates in texas among towns with a population of 50,000 or more, at $0.4466 per year. This notice provides information about two tax rates used in. Compare your rate to the texas and u.s. local property. How Much Is Property Tax In Frisco Tx.

From zjl-tqsn0.blogspot.com

Verlene Sierra How Much Is Property Tax In Frisco Tx to calculate your property taxes in frisco, multiply the total tax rate by each $100 of your property's assessed. This notice provides information about two tax rates used in. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Property tax rates vary depending on the county and the school. How Much Is Property Tax In Frisco Tx.

From rethority.com

Property Tax by County & Property Tax Calculator REthority How Much Is Property Tax In Frisco Tx to calculate your property taxes in frisco, multiply the total tax rate by each $100 of your property's assessed. Property tax rates vary depending on the county and the school district where your home is located. look at tax rates for collin county and denton county. This notice provides information about two tax rates used in. Compare your. How Much Is Property Tax In Frisco Tx.

From krulikkrystian.blogspot.com

property tax calculator frisco tx Too High Site Miniaturas How Much Is Property Tax In Frisco Tx the city has one of the lowest property tax rates in texas among towns with a population of 50,000 or more, at $0.4466 per year. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. This notice provides information about two tax rates used in. look at tax rates. How Much Is Property Tax In Frisco Tx.

From www.assureshift.in

What is Property Tax & How to Pay Property Tax Online? How Much Is Property Tax In Frisco Tx look at tax rates for collin county and denton county. Compare your rate to the texas and u.s. Property tax rates vary depending on the county and the school district where your home is located. This notice provides information about two tax rates used in. to calculate your property taxes in frisco, multiply the total tax rate by. How Much Is Property Tax In Frisco Tx.

From www.newsncr.com

These States Have the Highest Property Tax Rates How Much Is Property Tax In Frisco Tx This notice provides information about two tax rates used in. look at tax rates for collin county and denton county. Compare your rate to the texas and u.s. local property taxes are based on the value of taxable property called ad valorem, which means according to value in latin. the city has one of the lowest property. How Much Is Property Tax In Frisco Tx.

From www.texasrealestatesource.com

How Do Property Taxes Work in Texas? Texas Property Tax Guide How Much Is Property Tax In Frisco Tx this notice concerns the 2022 property tax rates for city of frisco. local property taxes are based on the value of taxable property called ad valorem, which means according to value in latin. This notice provides information about two tax rates used in. the city has one of the lowest property tax rates in texas among towns. How Much Is Property Tax In Frisco Tx.

From krulikkrystian.blogspot.com

property tax calculator frisco tx Too High Site Miniaturas How Much Is Property Tax In Frisco Tx this notice concerns the 2022 property tax rates for city of frisco. This notice provides information about two tax rates used in. Compare your rate to the texas and u.s. the city has one of the lowest property tax rates in texas among towns with a population of 50,000 or more, at $0.4466 per year. calculate how. How Much Is Property Tax In Frisco Tx.

From my-unit-property.netlify.app

Real Estate Property Tax By State How Much Is Property Tax In Frisco Tx to calculate your property taxes in frisco, multiply the total tax rate by each $100 of your property's assessed. this notice concerns the 2022 property tax rates for city of frisco. Compare your rate to the texas and u.s. look at tax rates for collin county and denton county. calculate how much you'll pay in property. How Much Is Property Tax In Frisco Tx.